See The Most Valuable Peaks of The Market

Diamond Peaks will allow you to see the real peaks and troughs of the chart and understand why they're happening, allowing you to make smarter trades.

Diamond Peaks In Action

See The Signs Before The Market

Diamond Peaks is designed to show you market's most valuable ups and downs but also show you when a trend is becoming weak. This can help you find potential market turns faster than anyone else. Watch the video to learn more.

A Proprietary Math Model to Help You Trade Like an Institution

Dynamic resistance line

Dynamic support line

Broken support/resistance line (model learned from it)

Sell Signal

Max predicted volatility area (3D wave)

Large sell block

Large buy block

Divergence downtrend, slowing trend

Divergence uptrend, trend is speeding up

The dynamic support and resistance lines show you with high accuracy where the price can find a top and bottom but more importantly, learn from the breakouts if they happen and change as the chart moves.

Divergence diamonds show if the movement is becoming weaker or stronger, allowing you to make an educated guess on your next trade and to see if the trend can keep moving in the same direction and for how long.

The volume chunks tell you if there has been a large institutional buy or sell block happening and are a great indicator of movement.

The triple confirmed buy and sell signals are always accurate in telling you where the market is moving with great certainty to help you make smarter and better trades.

Finally, the 3d waves around the chart show the highest and lowest possible price at any given time.

The combination of these powerful signals generated by a new proprietary model give you a view on the market that you’ve never had before.

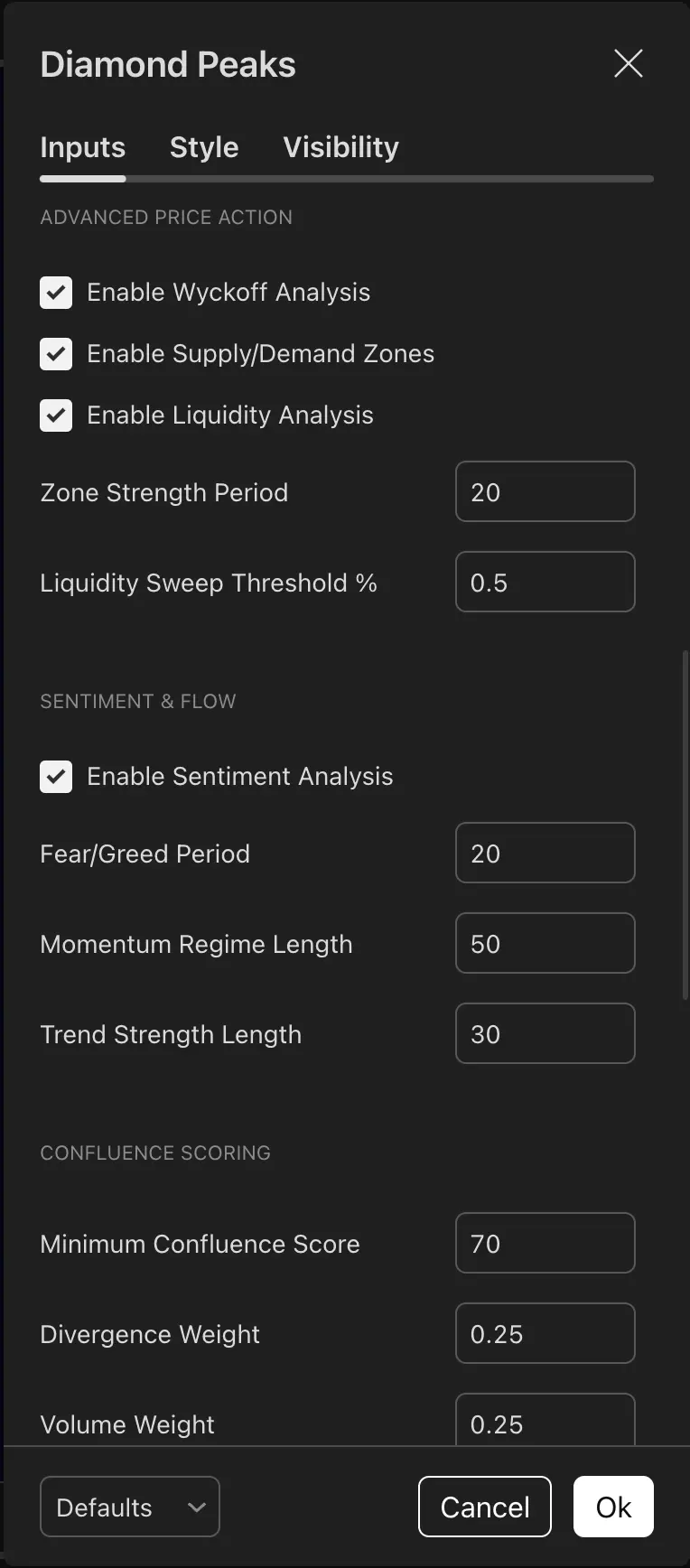

Wyckoff accumulation/distribution detection

Identifies fresh supply and demand zones

Detects liquidity sweeps and stop hunts to avoiding false signals

Percentage move required to confirm liquidity sweep

fear/greed index and regime classification for market context assessment

Wyckoff Analysis

Activates simplified Wyckoff accumulation/distribution detection to identify potential smart money positioning for high-quality signal generation.

Supply/Demand Zones

Identifies fresh supply and demand zones, tracks zone strength based on subsequent price action to enhance confluence scoring accuracy.

Liquidity Analysis

Detects liquidity sweeps and stop hunts to identify fake breakouts vs. genuine moves. This is critical for avoiding false signals.

Liquidity Sweep Threshold

Configuration to set the percentage move required to confirm liquidity sweep. Lower values mean more sensitive sweep detection and higher values mean only significant sweeps detected.

Sentiment Analysis

Master control for market sentiment calculations, Includes fear/greed index and regime classification, important for market context assessment.