The Most Sophisticated Adaptive RSI Indicator In The World

For the first time in the world, we used Monte Carlo logic with an advanced neural network to create an adaptive RSI that has an astonishing accuracy and changes with the market conditions on any timeframe.

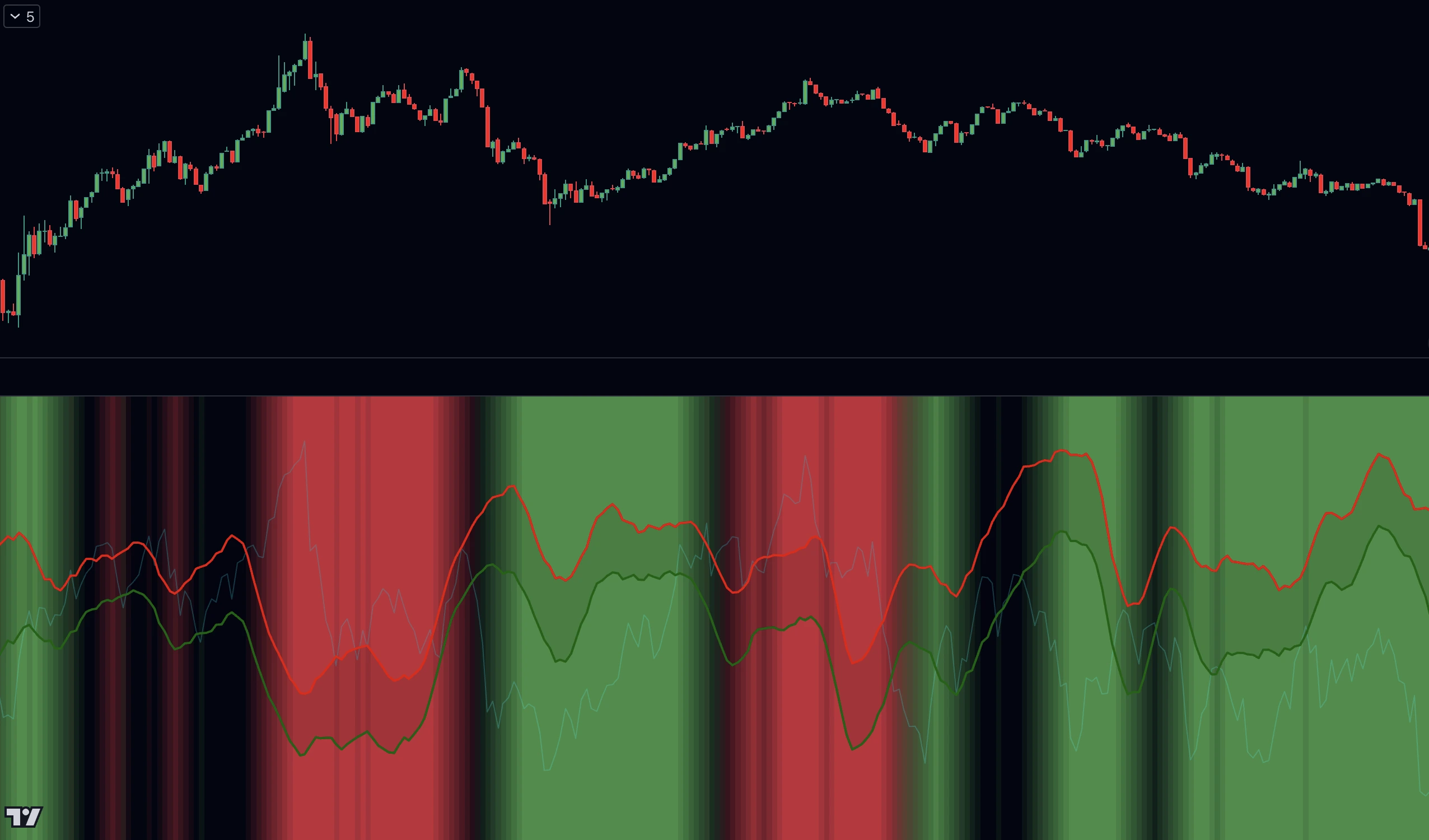

Monte Carlo RSI In Action

Adapt and Profit With MC RSI

The Monte Carlo Random Walk RSI indicator revolutionizes the traditional RSI by replacing static overbought/oversold levels with dynamic, statistically-driven bands that adapt to market conditions.

Propel Yourself Into The World Of Profitable Trading

Overbought trend

Oversold trend

Monte Carlo RSI upper and lower bands

Common RSI over Monte Carlo RSI band crossover

The Monte Carlo RSI indicator creates a dynamic RSI band on top of the common RSI. When the common RSI passes the band in any direction, it is an indicator of a direction change.

On top of that, using the random walk and a bit of machine learning, the indicator displays dynamic overbought and oversold levels on background.

When the market is oversold, the green background starts to appear and when the market is overbought, the red background indicates an overbought trend.

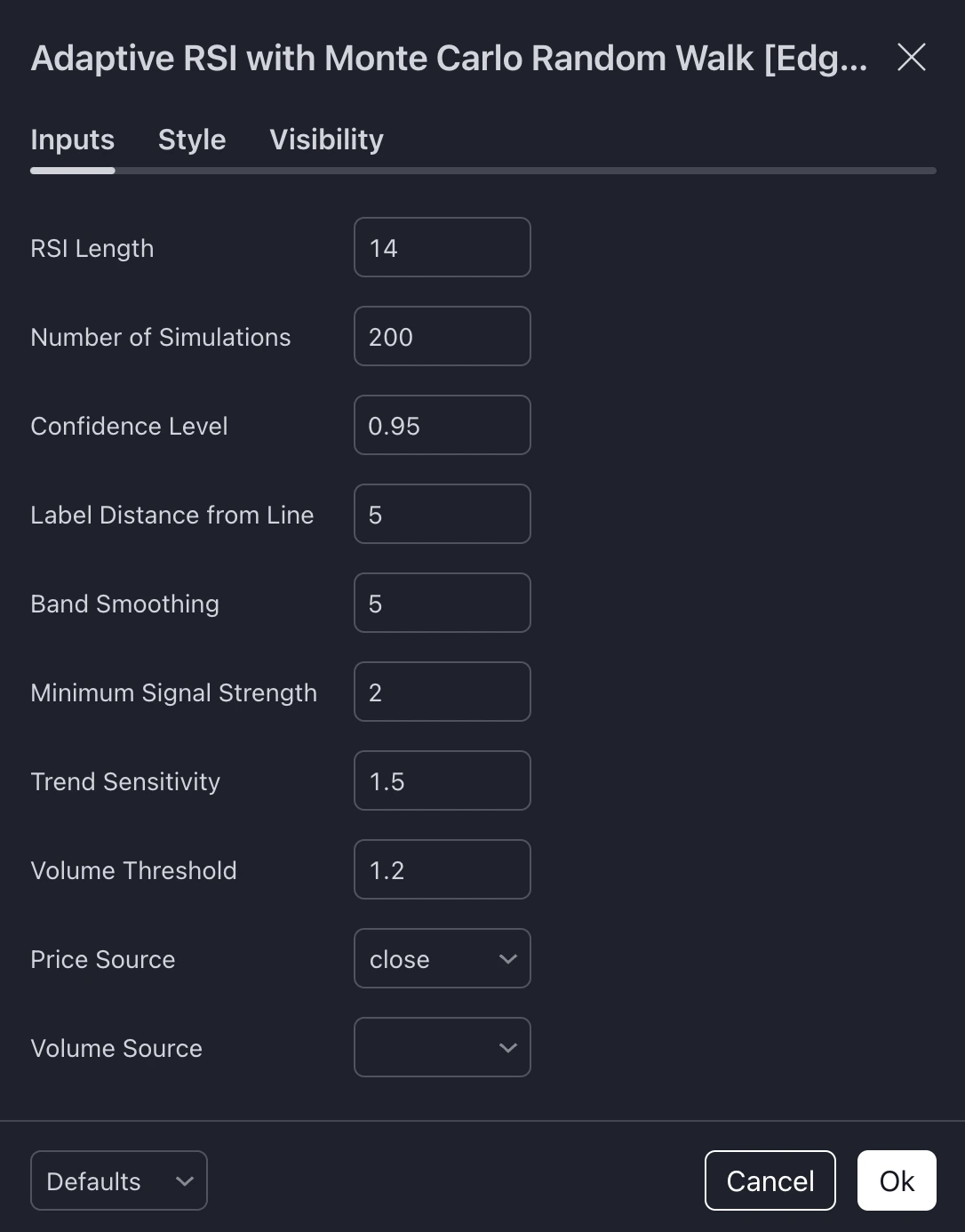

Controls Monte Carlo simulation count

Statistical significance of bands

Normalizes RSI deviation by ATR

Strength relative to volatility

Compares current volume to average

Number of Simulations

Controls Monte Carlo simulation count. Higher values result in more accurate bands, but lower calculation. More simulation means you get a better normal distribution, reducing random variation in bands.

Confidence Level

Controls statistical significance of bands. Higher values result in wider bands, meaning fewer trading signals are generated.

Minimum Signal Strength

The higher the value, it requires stronger moves. It uses ATR for volatility normalization and creates standard deviation equivalent.

Trend Sensitivity

Measures trend strength relative to volatility. Higher values filter more trending conditions.

Volume Threshold

Higher values require stronger volume confirmation. It validates price movement and confirms institutional participation.