Trading indicators to position you light years ahead

Edge Terminal enhances your TradingView charts with advanced trading tools, offering customizable workflows, comprehensive screening, and sophisticated backtesting for traders and investors of all types.

Brand New

Diamond Peaks: Catch Market's Most Valuable Ups and Downs.

A new math model to find market's most valuable tops and bottoms with an adaptive support and resistance model, to help you make smarter and better trades. Best when used with Adaptive RSI to make

Strong buy and sell signals

adaptive resistance line

adaptive support line

bullish divergence signals, indicating a weakness in downtrend

bearish divergence signals, indicating a weakness in uptrend

Monte Carlo AI Based RSI: A New Age, a Better RSI.

A completely new take on the relative strength index indicator. This Indicator uses random walk and our 256-point neural network to adapt to the market movement, showing you the real highs and lows of the market live.

Overbought area

Oversold area

Monte Carlo AI RSI lower limit area

Monte Carlo AI RSI upper limit area

Monte Carlo AI RSI general direction

Generic RSI crossover

How many random walk Monte Carlo simulations to perform for each bar

Threshold of volume to watch out for to detect RSI change

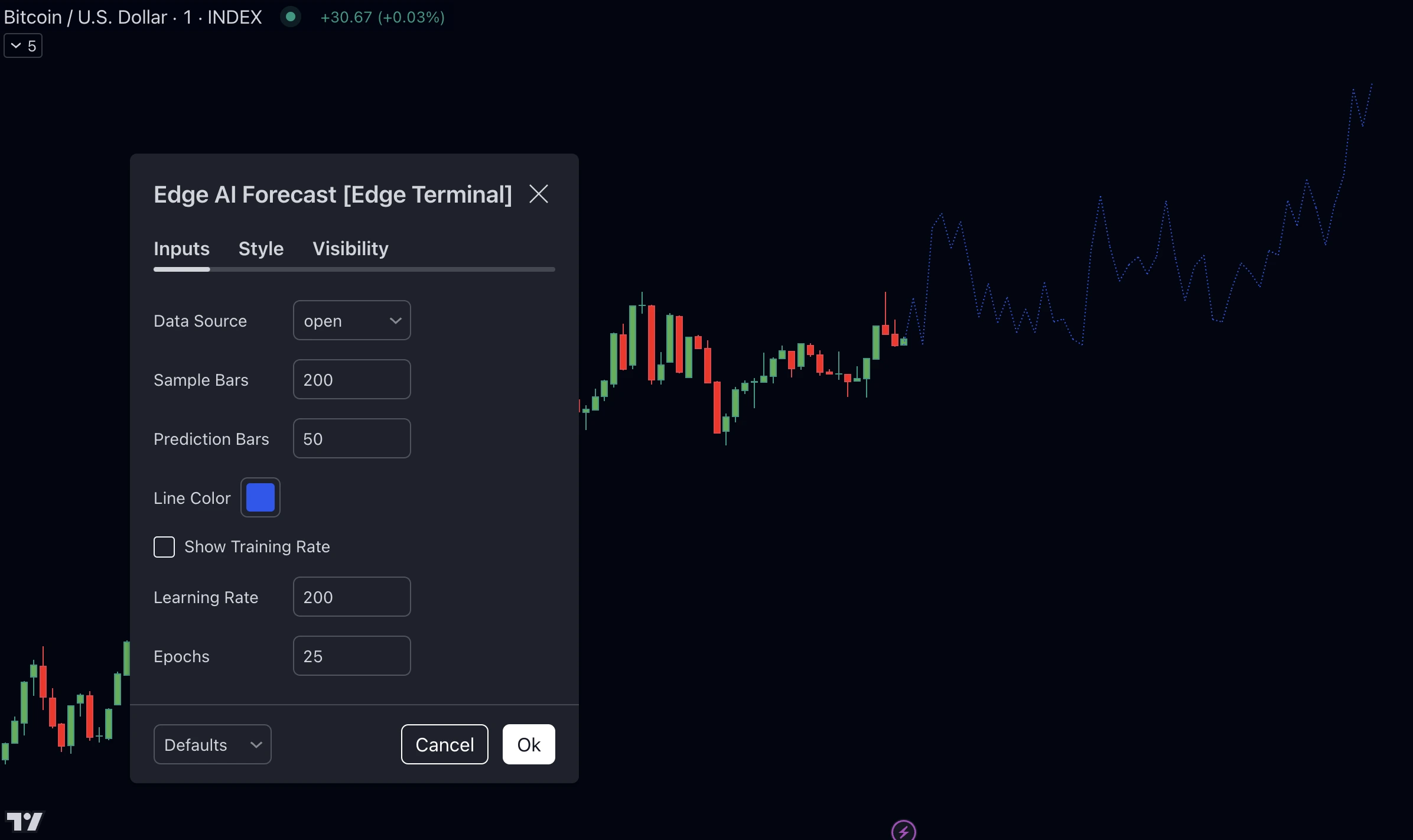

Edge AI: See What Other's Can't See, Get Ahead.

Our most advanced indicator yet. It puts 82 different market data points into a 256-point neural network, the first of its kind on TradingView, to predict the potential movement of the trend, with high accuracy. It's used in both short and long-term trading styles and works on any asset.

Trend prediction by AI

How many bars to use as sample data for AI

How many bars to predict on the chart

How many times to run the neural network per each bar (to learn)

Golden Slope: Institutional Trading Gold Standard.

Golden Slope shows what smart money sees and does. Institutional order blocks show you the hidden support and resistant levels, the KNN machine learning model gives you the most reliable buy and sell signals, and the ATR-based trend wave shows you the direction and intensity of the trend.

Institutional buy block

Institutional sell block

Market direction strength wave

Buy signal based on KNN machine learning

How many periods to look at to detect institutional blocks

Double confirmation of the Long Returning Range formula using AI

Popular

Volume Signals: See Where The Money Flows and Follow It.

Volume and its direction are one of the most important indicators of price in the market. The Volume Signals detect the large volume blocks and their flow and generate accurate buy and sell signals based on the intensity of the block. Best used in high-volatility assets for fast trades.

Sell signal based on volume trend

Buy signal based on volume trend

Positive volume block

Negative volume block

Moving average to detect the peak of the volume trend

Volume lookback range bars to compare for change detection